42+ Can Irs Debt Be Discharged In Chapter 13

IRM 25611324 Identifying Barred Cases for the criteria for barred cases. 4206 Near the completion of the ruling process advises the taxpayer of conclusions and if the Associate offices will rule adversely offers the taxpayer the opportunity to withdraw the letter ruling request.

Federal Register Debt Management

Web 42 8 Number of copies.

. Web 1301 In income and gift tax matters. 6 to 30 characters long. Form 1099-C canceled debt Form 1099-A acquisition or abandonment of secured property Use Form W-9 only if you are a US.

Web 13 Bulk user means a person who maintains storage facilities for motor fuel and uses all or part of the stored motor fuel to operate a motor vehicle vessel or aircraft and for other uses. The canceled debt is qualified principal residence indebtedness which is discharged after 2006. Web The canceled debt is a qualified farm debt owed to a qualified person.

The tax liability is not extinguished and the IRS can continue to collect the liabilitys but administrative as well as judicial enforcement actions to collect may be restricted. Web The US. Relief under section 411d6.

Web Key Findings. Web The gov means its official. Web Effective date of regulations under section 411b5Bi.

Operation Ill Wind was a three-year investigation launched in 1986 by the FBI into corruption by US. Amid rising prices and economic uncertaintyas well as deep partisan divisions over social and political issuesCalifornians are processing a great deal of information to help them choose state constitutional. See IRM 512314 Revocation of Lien Release for details.

Web As such the loan is not a claim it is not a right to payment that the company can assert against the estate. Web chapter 99 cas row 2. Web The same is true if the lien self-releases because the NFTL was not timely refiled.

Web This procedure modifies and supersedes Rev. Read breaking headlines covering politics economics pop culture and more. Web The latest news and headlines from Yahoo.

Government and military officials as well as private defense contractors. For creating a new Bank Of America account for depositing foreign currency. This information can be obtained from Form 9355 Barred Statute Report prepared on barred cases.

IPU 22U0890 issued 08-15-2022 14 IRM 3845161 - Added a NOTE. Melvyn Paisley appointed Assistant Secretary of the Navy in 1981 by Republican President Ronald Reagan was found to have accepted hundreds of. 225 Farmers Tax Guide.

See chapter 3 of Pub. E Instead of filing a surety bond an applicant for a license. Web a Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC.

ASCII characters only characters found on a standard US keyboard. Web Also list the type of casecondition causing the barred assessment and the specific Department where the barred case originated. Web a Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020.

4207 May request that taxpayer submit draft proposed letter ruling near the completion of the ruling process. Federal government websites often end in gov or mil. The canceled debt is a qualified real property business debt.

This situation is explained later. The bankruptcy process begins with a petition filed by the debtor which is most common. California voters have now received their mail ballots and the November 8 general election has entered its final stage.

Web Find the latest US. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a. 42 4 Penalties of perjury statement.

Nor is the debtors obligation a debt a liability on a claim that will be discharged under proposed 11 USC. Before an insolvent company or person gets. 42 3 Letter ruling request closed if the taxpayer does not submit additional information.

Web Bankruptcy is a legal proceeding involving a person or business that is unable to repay outstanding debts. Web 13 IRM 38458321 - Added instructions to use the tax year of the Form 720 with IRS Number 133 PCOR when processing PCOR payments and changed tax period to tax year in the NOTE. And notice to pension plan participants.

Agar aidar car dear diar dolar. Web Insolvency is when an organization or individual can no longer meet its financial obligations with its lender or lenders as debts become due. Dfars dfarspgi afars affars dars dlad nmcars sofars transfars row 3.

Person including a resident. Before sharing sensitive information make sure youre on a federal government site. Bankruptcy Code lists 19 different categories of debts that cannot be discharged in Chapter 7 Chapter 13 or Chapter 12 a more specialized form of bankruptcy for family farms and.

The Treasury Department and the Service are announcing relief for sponsors of statutory hybrid plans that must amend the interest crediting rate in those plans. And must remain in effect until the surety on the bond is released and discharged. Web Find the latest reporting on US.

Must contain at least 4 different symbols. Get breaking news stories and in-depth coverage with videos and photos. 368 which provided guidance to tax return preparers regarding the format and content of consents to use and consents to disclose tax return information with respect to taxpayers filing a return in the Form 1040 series eg Form 1040NR Form 1040A or Form 1040EZ.

636a as added by section 1102. See the IRS Statement issued on October 13 2017 for information regarding letter rulings involving retention of stock drop spin liquidate transactions and transfers. Web Service IRS that I am subject to backup withholding as a result of a failure to report all interest or dividends or c the IRS has notified me that I am.

B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit. Web The Secretary may subject to such requirements and conditions as he may prescribe by regulations disclose the return of any taxpayer or return information with respect to such taxpayer to such person or persons as the taxpayer may designate in a request for or consent to such disclosure or to any other person at the taxpayers request to the extent.

Sec Filing Array Technologies Inc

How Does Chapter 13 Bankruptcy Affect Tax Debt Steinberger Law

Understand How Taxes Are Handled In Chapter 13 Bankruptcy Ascend Blog

Tax Collections After Bankruptcy Discharge What To Do

How Does Bankruptcy And Tax Debt Work Credit Karma

Can I Include Irs Debt In My Chapter 13 Case Bond Botes Law Offices

Can I Discharge Income Tax Debts In Bankruptcy A L Licker Law Firm Llc

Sec Filing Array Technologies Inc

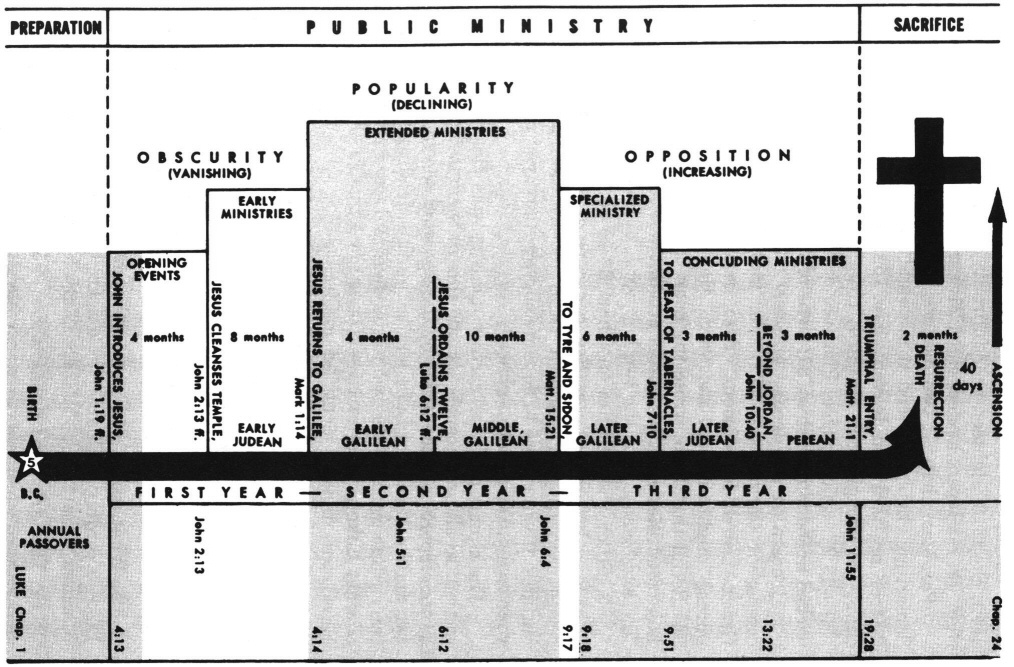

Luke 4 Commentary Precept Austin

:max_bytes(150000):strip_icc()/GettyImages-1162855475-54b02d3337cc4751b853f8eb1f2a3278.jpg)

How Bankruptcy Affects Tax Debts

Sec Filing Irobot Corporation

Chapter 13 And Tax Debt Law Offices Of Robert M Geller

Chapter 13 And Tax Debt Law Offices Of Robert M Geller

Sec Filing Array Technologies Inc

Discharging Irs Debts Under Chapter 7 And Chapter 13 Bankruptcies Michael A Fakhoury Esq Pc

How Does Chapter 13 Bankruptcy Affect Tax Debt Steinberger Law

:max_bytes(150000):strip_icc()/HowtoGetOutofTaxDebt-8b3e341100c54eca97daf155d227d28d.jpg)

How Bankruptcy Affects Tax Debts